Guide to Using Credit Cards to Build Credit

As a business owner, or as someone aspiring to become one, there are many expenses that will stand in the way of achieving your big business goals.

Your dreams won’t wait for your bank account to grow bigger, so how can you make any progress without draining your savings?

The short answer is, credit. According to the Federal Reserve Bank of Boston, roughly 75% of all American consumers have a credit card. Credit cards are a popular way to get your hands on money, but there are some important questions to think about…

Questions you should ask yourself:

- How do you build credit?

- Are credit cards good for building credit?

- What is a credit score useful for?

- What are the advantages of building strong credit?

There’s a lot to know, but luckily we’ve already put the necessary info together for your benefit. Learn all there is to know about how to use a credit card to build credit score below.

One important note: Of course, the type of business will affect the kind of industry loans a business needs, as well as the specific circumstances that business finds itself in. Be sure to weigh your options carefully in order to choose the right funding solution for your business.

Credit cards 101

New to the world of credit cards? Fear not, we’ve put together a short-and-sweet breakdown for you here:

What is a credit card?

A credit card is essentially a tool that allows you to use funds that you don’t have on an as-needed basis. If you need to make a big purchase and you either don’t have the funds or don’t want to use your savings, credit cards are a viable solution.

When an unexpected emergency arises, your credit cards can help get you out of a jam. Many credit cards will even allow you to take a cash advance in the event you need it.

The uses for credit cards are endless, but this still begs the question: why should you care about credit?

Why you should care about credit

Simply put, without a good credit score, you’ll likely have a more difficult time getting approved for a mortgage, business loans, auto financing, and even certain jobs. Your credit score acts as a way for institutions, financial and otherwise, to take a quick peek at your financial health.

A poor credit score could, for example, result in higher interest rates for loans, insurance premiums, and so on.

If you own a business you likely already know how important your credit card is to the functioning of your company, and the advantage there is to having a high credit score.

Not all credit cards are designed equally though. Depending on a wide variety of factors, including your financial history and the credit card company you are looking at, there will be a variety of interest rates, credit limits, and rewards associated with the credit card you choose.

Having a credit card ≠ a good credit score

Every time you open a new credit card, your credit score will be slightly negatively affected. So if that’s the case, why would anyone consider using credit cards to build credit?

In the short-term opening a credit card can initially harm your credit; the size of the negative effect on your credit score will depend on several factors, including your credit history. In the long-run, though, using a credit card wisely is a very practical and smart way to build your credit score.

But once you’ve gotten the credit card in hand, it won’t be enough to just go use it without any care in the world.

For those of you who want to know how to use credit cards to build credit score, it’s not such a huge secret – all you need to do is spend wisely! That’s much easier said than done. Keep reading to get some insider tips from Become on how to use credit cards sensibly.

How to use a credit card to build credit score

For first-time credit card users, it can be tempting to ‘swipe away’ financial troubles. That’s not what we would call using your credit card wisely. There are some fundamental pointers that every credit card owner should keep in mind when using credit cards to build credit.

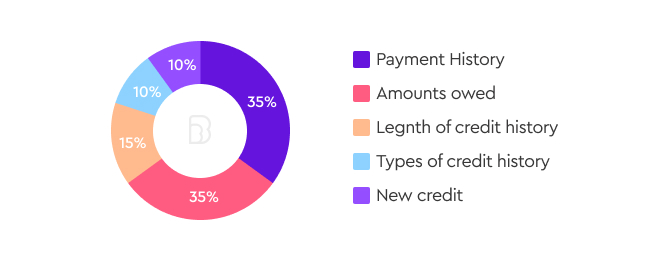

First off, your credit score is calculated by considering several factors.

The most common equation, implemented by FICO, focuses on five factors:

With those factors in mind, let’s take a look at how to use a credit card to build credit score. How are credit cards good for building credit?

Beginner basics of using credit cards:

1. Limit your spending to a few isolated payments a month. Subscriptions, utilities, rent, etc. Stay consistent, and don’t be erratic with the amount you put on your card every month.

On the same note, you shouldn’t consistently max-out your credit card. Too much dependence on your credit card is not a good sign to your credit company or to credit agencies and can affect your ability to extend your line of credit or take a cash advance.

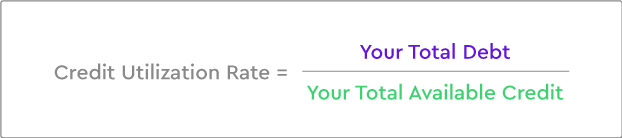

Your credit score will be partly based on your credit utilization. Credit utilization is defined as ‘the sum of all your balances, divided by the sum of your cards’ credit limits’. A higher ratio means you may have a difficult time paying off debts, while a lower ratio indicates you have your finances in order.

The target for credit utilization is generally recommended at 30% or under. This means if the limit on your credit card is $1,000, you should aim not to let your balance exceed $300.

You can improve your credit utilization by either limiting your purchases or by extending your line of credit. Just be careful not to use an extension on your line of credit as a reason to spend more… which brings us to our next pointer.

2. Keep your line of credit limited to what you can afford. Set the limit to be lower than your monthly income. In this way, you’ll be using your credit card as if it were a debit card. If you only allow yourself to spend as much as you know you can pay off, then you’ll never have a difficult time making your monthly payment.

As a result, you won’t carry any credit card debt and there’ll never be an opportunity to develop interest on that debt.

There’s no point in overextending yourself, because if you miss a payment your credit score will suffer, and you will have defeated the purpose of opening a credit card in the first place.

3. Pay your balance every month on time and in full. Schedule automatic payments so you don’t run the risk of forgetting to pay on time.

Quick tips for scheduling payments:

- Adjust your billing due dates so they don’t all fall on the same day

- Schedule your due dates for after your payday so that you’ll be able to pay off your balance

- Make your credit utilization appear lower by timing payments for right before the end of the billing cycle

Tips for experienced credit card users:

1. Open several cards, but rely on one primarily. Before we go any further, if you are new to credit cards, you should wait until you’ve become comfortable with the process of handling one credit card before opening more. It can be risky to open several cards for a person who hasn’t had time to balance credit card usage effectively.

But, if you know how to manage your credit utilization responsibly and are able to make your payments on time, there can be benefits to having multiple credit cards at your disposal, including:

- Organizing your expenses with separate credit cards for separate uses, for example:

-

- one card for personal purchases

- one card for regular business payments

- one card for business emergencies

-

- Benefiting from the reward programs or discounts offered by certain credit cards

- Paying off debt on one credit card with another card that has 0% interest

- Extending your overall line of credit as a way to improve your credit utilization ratio

What you won’t want to do is open up too many cards within too short a period of time. As mentioned above, every time you open a credit card your credit score takes a small hit.

Another mistake you’ll want to avoid is closing accounts, as that can also negatively impact your credit score. When you close a credit card, you’ll be effectively shortening your credit history (which makes up 15% of your credit score).

By closing a credit account, you’ll also be shrinking your overall line of credit, which will increase your credit utilization ratio and potentially have a negative effect on your credit score.

Make sure to look into the benefits of monitoring your credit score.

Bottom line: always use fewer cards than you have.

2. Should you finance your business with credit cards? Frankly, it depends on your business’s specific financial situation. For more than 65% of small businesses, statistics show that credit cards are frequently used as a source of financing.

If you’re looking to expand your business or need to replace expensive equipment, you should, of course, check if you can qualify for business loans first.

Tip for Australian borrowers: One common problem for Australian borrowers is that, if you didn’t get enough money in your first loan, and then want another, other lenders will be very wary since you already have a loan with someone else. Credit cards are an excellent way to get the funding your business needs, without worrying about strict approval processes.

But, regardless of whether or not you get approved for a business loan, credit cards are another source of funding that can help you increase your credit score in the long term (as discussed under the heading ‘Having a credit card ≠ a good credit score’).

Credit card financing is a particularly good option in the event that all you really need at the moment is an extra boost to make small purchases or payments. It’s not necessary to take out a $20,000 loan if you need just $600 to make the changes you need.

Start using credit cards to build credit, finance your business, and cover all of your expenses with transparency and security. There are a wide variety of companies and card types to select from, and some may fit your specific needs better than others.

Short recap

Let’s quickly summarize what the main takeaways are from this credit card guide:

Top 3 ways to improve your credit score:

- Improve your credit utilization by increasing your credit limit and keeping your spending low.

- Keep your first credit card account open in order to maintain a longer credit history.

- Schedule automated payments in order to maintain a stronger payment history.

A credit card is a great tool when used wisely. Those little pieces of plastic can dig you into a hole as easily as they can pull you out of one. Handle them with care and you’ll be able to answer the question “are credit cards good for building credit?” with a resounding “yes!”

We hope you find this information valuable and helpful. If there are any questions that you feel were left unanswered, drop us a comment below!

Please wait...

Please wait...